Reforming Colorado’s Broken Tax Code

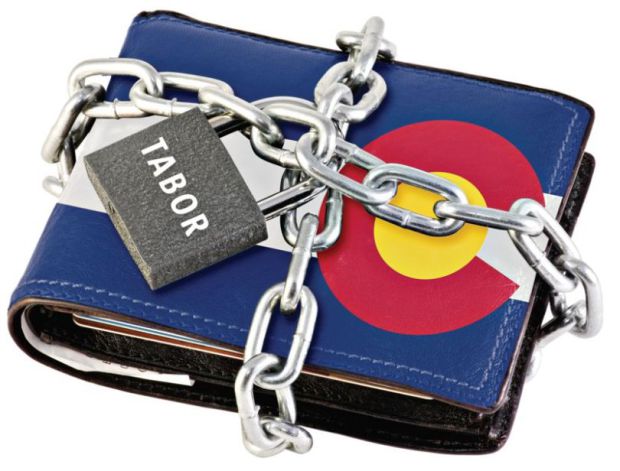

Enacted in 1992, Colorado’s Taxpayer Bill of Rights (TABOR) requires approval by taxpayers to raise taxes and to adopt changes in the structure of an outdated tax code. This essentially limits the ability of elected officials to serve Coloradans and ensure the state is prospering through appropriate allocation of state funds to the areas of greatest need and the areas with the greatest potential return on investment.

Arbitrarily limiting budget and tax options for the State of Colorado also limits the success that can be shared among Coloradans. TABOR prevents elected officials from responding nimbly to ever-changing conditions, instead requiring them to run the state based on rules that were adopted more than 20 years ago.

TABOR is causing Colorado to miss out on important opportunities for its students, its families and its citizens who rely on the state to create and maintain an infrastructure that drives economic success for all.

Colorado Common Cause is working with 14 other organizations and community leaders to remove the TABOR straight jacket and allow our elected leaders to invest in our state.